Sell My Howard County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Howard County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

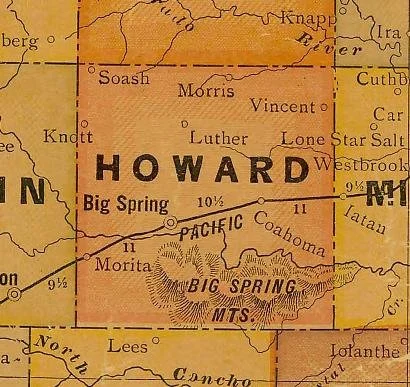

Howard County Mineral Rights: Owning and Selling Minerals in Howard County, Texas

Introduction

Howard County, Texas, known for its rich history and economic vitality, offers unique opportunities in the mineral sector. This area, steeped in a legacy of mineral exploration and development, presents compelling reasons for owning and selling minerals.

A Glimpse into Howard County's Past

Howard County's journey with minerals began over a century ago. The discovery of valuable resources led to a boom in mining and drilling activities, shaping the county's economic landscape. Today, it stands as a testament to the enduring value of mineral resources.

Why Mineral Ownership is Beneficial

Owning minerals in Howard County isn't just a matter of pride; it's a potentially lucrative investment. With a variety of minerals beneath its soil, the county offers a diverse portfolio for investors and landowners.

The Financial Upside of Selling Minerals

Selling your minerals can turn into immediate financial gain. Market trends in Howard County show a consistent demand, ensuring competitive prices for sellers. By tapping into this market, you can unlock substantial revenue.

Economic Contributions to Howard County

The mineral industry significantly impacts Howard County’s economy. From creating jobs to contributing to the local GDP, the sector is a key driver of growth and development.

Timing Your Sale

Knowing when to sell is crucial. Monitoring market trends and understanding the value of your assets can help you maximize returns. Professional advisors can provide invaluable insights in this regard.

Navigating Risks

While lucrative, the market is not without risks. Awareness of market volatility, legal nuances, and environmental concerns is essential. Mitigating these risks requires careful planning and expert advice.

The Importance of Professional Guidance

Engaging with a mineral broker can streamline the selling process. These professionals offer expertise in valuation, legal procedures, and market analysis, ensuring a smooth and profitable transaction.

Understanding Taxes

Selling minerals can have tax implications. Familiarizing yourself with capital gains taxes and other financial responsibilities is crucial to making a well-informed decision.

The Future Looks Bright

The mineral industry in Howard County shows promising future prospects. With continued demand and emerging opportunities, the sector is poised for further growth.

Diversifying Your Portfolio

Adding other assets to your investment portfolio can offer diversification benefits. Compared to traditional investments, minerals present a unique blend of risk and reward. This is why balancing your portfolio with other investments, such as real estate, can be a wise decision.

Environmental and Legal Considerations

Selling minerals also entails environmental and legal responsibilities. Adhering to sustainable practices and regulatory requirements is crucial for a responsible transaction.

The Global Stage

Howard County's minerals have a significant presence in the global market. Understanding these international dynamics can open up additional avenues for profit.

The Perfect Time to Sell

Current market conditions suggest that now is an opportune time to sell. With favorable prices and high demand, the timing couldn't be better.

Making Your Move

In conclusion, selling minerals in Howard County is a decision that warrants careful consideration. By understanding the market, assessing risks, and seeking professional advice, you can make a choice that aligns with your financial goals.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329